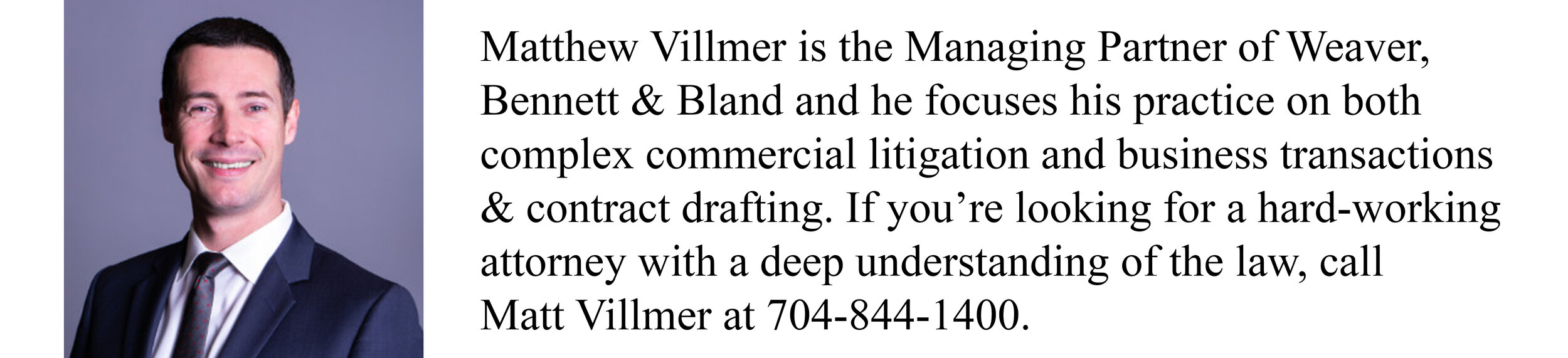

On March 28, 2020, the Coronavirus Aid, Relief, and Economic Security Act (“CARES”) was signed into law. CARES provides important economic relief to businesses throughout the U.S. This document covers frequently asked questions and the applicability of CARES to Weaver, Bennett & Bland’s business clients. If you have specific questions about the applicability of these provisions to your business, call us at 704- 844-1400 or e-mail us at mvillmer@wbbatty.com. CARES includes the following general provisions that you should be aware of:

PAYCHECK PROTECTION PROGRAM – SMALL BUSINESS LOANS

Overview: The Paycheck Protection Program allocates $350 Billion to small businesses, to help them keep their workers employed during the COVID-19 crisis. The program gives businesses 100% federally guaranteed loans that, under circumstances outlined below, may be forgiven if borrowers maintain their payrolls during the crisis, or restore their payrolls after the crisis.

Eligibility for Paycheck Protection Program Loans

Your business is likely eligible for a CARES loan if you are:

A small business or 501(c)(3) with fewer than 500 employees

A sole proprietor who regularly carries on a business

An independent contractor, or someone in the “gig economy”

A food sector business with fewer than 500 employees (on a per-physical location basis)

A small business that otherwise meets the SBA’s size standards

The “fewer than 500 employees” standard includes all employees—full-time, part-time, and independent contractors.

What Lenders Want to See in Your Loan Application: When applying for a CARES loan, lenders will consider whether you operated a business before February 15, 2020, and whether you had employees who were paid through regular payroll or as independent contractors. Lenders will also ask that you certify that the following is true, as a part of your application:

The uncertainty of current economic conditions makes the loan request necessary to support your ongoing operations.

You will use the loan proceeds to retain workers and maintain payroll or make mortgage, lease, and utility payments.

You do not have an application pending for a loan to be used by you for the same purpose and amount.

From February 15, 2020 to December 31, 2020, you have not received a loan that was used by you for the same purpose and amount; however, if you received an emergency COVID-19 bridge loan, you may be able to roll that loan into the CARES loan.

Importantly, lenders will not consider the following, when evaluating your application:

That you sought credit outside the CARES loan process, and you were denied.

That you cannot sign a personal guaranty, or that you have no assets to make a personal guaranty effective (a personal guaranty is not required).

That you lack collateral for the loan (collateral is not required).

How Much You Can Borrow

For the average small business, you can borrow up to 2.5 times your average monthly payroll costs, capped at $10 million. The calculation of average monthly payroll cost is performed as follows: